-

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

-

Posts

1,236 -

Joined

-

Last visited

Content Type

Forums

CGC Journals

Gallery

Events

Store

Posts posted by Loki

-

-

The same thing has happened to me before - a few times in fact. Usually it's a case of someone claiming to use a "stock photo" since they have multiple copies in the same grade (and thinking that all books with the same grade are equal).

However, it's still a bait-and-switch. Especially if the "stock photo" is a perfectly centered newstand version and you end up with a miswrapped direct version, as happened to me once...

- valiantman and Krismusic

-

2

2

-

20 minutes ago, JollyComics said:

GeezusWalks bought my books several times. I don't see there is any problem with the board member.

How long will this board member be on Probation List? 6 months? One year? How recent was the member put on the list?

Once on the list, the only way off is if the offended party agrees to remove them. So, basically on the list forever as it currently stands.

-

Just a heads up for any Canadians interested... Doom Patrol airs Tuesday evenings on the Space network, which I think is pretty commonly bundled in cable packages.

-

4 minutes ago, OrangeNemesis said:

Have we heard if there is an end credits scene yet? I know they didn't play the credits at the premiere so who knows?

One of the movie reviews I read earlier today says that there are no end credit scenes. None of the other reviews mentioned end credit scenes at all...

-

-

I enjoyed the movie. 7/10, definitely worthwhile seeing.

As for my opinion of the various WW vs CM comparisons, I think Gadot's portrayal of Wonder Woman was better than Larson's portrayal of Captain Marvel. However, I enjoyed the Captain Marvel story far more than that of Wonder Woman.

- Juno Beach, meshuggah and Sweet Lou 14

-

3

3

-

I'm currently about halfway through the third / final season... All I can say is "Wow, this is great". Easily the best season in the series and the best of all the Marvel-Netflix shows. I can't understand why they'd cancel a show this good.

I also can't understand how the same studio that produced this could also turn out carp like Iron Fist. Seems like a massive range in quality... :P

-

On 12/10/2018 at 9:00 AM, MetaHuman said:

It's too bad they aren't part of the Elseworlds cross-over. I really loved Crisis on Earth X last year.

I actually thought they had the best part of the cross-over...

Gideon: While you were out, you missed emergency phone calls from Oliver Queen, Barry Allen, and Kara Zor-el

Nate: (sigh) Sounds like the annual cross-over again. Hard pass.

-

3 hours ago, fantastic_four said:

I really freaking loved the previous Spider-Man masterpiece game from 2004, Spider-Man 2, so I knew the potential was here for this game. I'm hugely interested, but I doubt I'll get a PS4 just for this one game.

^ What he said... :P

I'm really hoping (in vain) that they'll port it over to PC or XBox.

-

On 7/21/2018 at 1:36 AM, fmaz said:

I liked him better in the Defenders, and I hear he came across well in Luke Cage season 2 (we’re only 1/2 way through so we haven’t seen him yet)... so I have moderate hopes for this. I know it can’t be worse than season 1! Even just in the trailer, it looks like he’s learned how to fight a bit better and the IF effect is cool, so that’s something.

Yeah, he came across much better in Luke Cage 2. His character seemed to have matured a lot from IF1 and the Defenders. He wasn't the same whiny, petulant, "act first, think later" jerk from those earlier appearances. If they manage to keep writing him in the same style, he might turn into a half-way decent character.

-

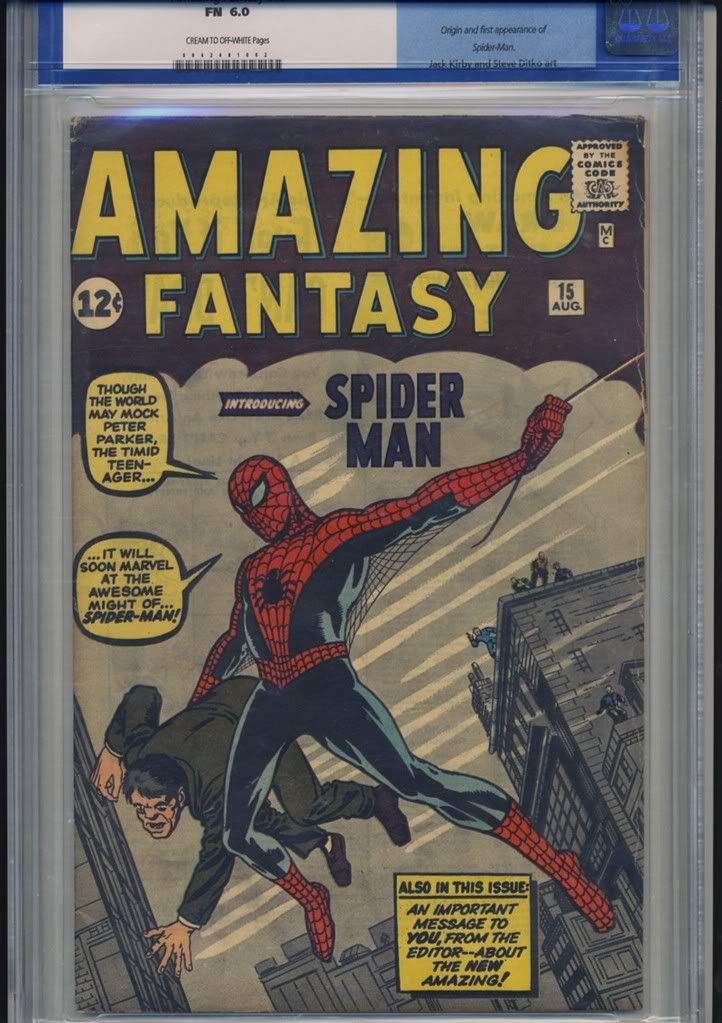

I doubt I'll ever make a purchase bigger than this one... I bought this one here on the boards for $8500 about 10 years ago.

- TheWatcher, Larryw7 and badback83

-

3

3

-

14 hours ago, Bosco685 said:

Canada gets the show early, doesn't it?

It

airsaired on Sunday evenings here. I'm not sure what day everyone elseseessaw it on, though... -

At the very least, I'd hope someone would do a 2-hour movie to wrap up that cliffhanger...

-

On 1/18/2018 at 7:49 AM, ComicConnoisseur said:

I missed it.

Anybody know where I can catch it?

It's available on Netflix. At least in Canada...

I didn't even realize it was on a Network - Netflix sent me a "show you might like" email, so I assumed it was a Netflix original.

-

Seems kind of odd that the RCMP would simply close the case because the stolen property got returned. Perhaps this is simply a case of them not taking things seriously because the property in question is a bunch of comic books?

If someone stole my car for a few months and then it was mysteriously returned, I'd still want the thief caught and dealt with appropriately.

-

So the little girl with the drawings from the Fitz & Hunter episode?

-

Well that was both entertaining and somewhat different than what I was expecting.

Looking forward to another great season. Hopefully Fitz resurfaces at some point, though.

-

You could always opt for ASM 134, the Punisher's equivalent to Wolverine's Hulk 180.

-

I really hope someone fries Netflix over the sleazy email promo they sent just out... "Suspicious Activity" alert as the title, morphs into a Punisher advert when you open it.

-

18 minutes ago, fantastic_four said:

Why were there a bunch of beehives in that post-nuclear city Deckard was in?

I just assumed it was because Deckard had taken to beekeeping in his "retirement"...

Plus it sets up an Easter Egg throwback to the "You see a wasp crawling on your hand" line from the original movie. Rachel immediately responded with "I'd kill it" while K just watches the bee. Who had the human response and who had the replicant response?

-

I went to see it at the IMAX last night. It may be 2h 43min, but the time flew past and the story really draws you in. I don't really want to go into details, as I don't think I'd be able to discuss the plot without spoiling it for others...

I was worried that a sequel to one of my favorite movies would be nothing but a letdown, but I REALLY enjoyed it. I think this one will we well received by fans of the original.

-

I'll be curious if the "5 years ago" flashbacks go to events of Season 1 that we weren't privy to...

-

Yeah, I've seen a few teasers for this game over the past few months. Looking like the best Spidey game since the old Spider-man 2 movie tie-in.

I'm just pissed that there's no Xbox version. I'm not likely to buy a PS4 just to play a single game.

-

20 hours ago, AnonymousAF15 said:

As an outsider just getting into this market I thought I would share:

I ran an analysis on all the keys from the 1960s and looked at their 5-year annual returns since 2002 (first year with real data) at every grade level. I found some interesting insights I'm acting on, but thought I would publicly share some basic stuff about AF15 to get people on the same page:

- AF15 has increased in value at every grade level at the same rate - so the ratio in price between a 4.0 and 9.0 has stayed basically flat the whole time. So there hasn't been an acceleration in the top or the bottom. Everything is increasing in tandem. This is what you would expect if there wasn't a big new source of supply (i.e., someone finds a bunch of 9.0s - that should change the price ratios). Since I don't have supply numbers over time I can't test this (does anyone have that?)

- The 5-year CAGR (% increase in value per year) on AF15 across all grades from 2002 to present (data available) is +15% per year. That is a FANTASTIC return. And it has consistently been +15% for every grade level for every 5-year span available. That doesn't mean it will continue. It is also a pretty small data set. Given the correlation between the grades that's only 14 years of data

...Based on that if you believed that things would continue the way they are, you should be buying AF15s as fast as possible. If everyone realized this and started doing it the price would be driven up. So how high should you be willing to buy? If you think the OLD CAGR rate will hold, then it depends on how long you are willing to hold for.

Let's assume the price last year was $100 (feel free multiple by whatever integer you like). Then the expected value over time will be (without bubble effects and without any change in the 5-year CAGR):

2017: $115

2018: $132

2019: $151

2020: $174

2021: $200

...

2026: $400

2031: $800

(15%/year means a double every 5 years - which is nice and simple)

So let's say you were planning to hold until 2031. And let's say you wanted to make a 10% return per year (VERY good). You think that it will sell for $800 in 2031. You will be holding for 14 years, so if you buy for $200 in 2017 (2x the 2016 price), your asset still makes you 4x in fourteen years - or a CAGR of 10.4% per year...

I know a lot of people on here talk about quick flips, but as asset classes get more sophisticated quick flips stop working (at least consistently). And transaction costs kill you. So the only reason to buy an appreciating illiquid asset is if you plan to hold for a long time. And if you are planning to hold for a long time AND last year's prices are about right AND last year's prices will continue to increase at the rate they have been increasing for the last 16 years AND you are ready to hold for 14 years AND you want to make a 10% return per year (less transaction fees) - then 2x last year's prices are about right.

If you want to hold longer - say 24 years, then you should be willing to spend even more. If you are willing to take a less than 10% return then you should be willing to spend more. If you think it will increase in value faster than 15%/year (based on last year's prices) then you should be willing to spend more...

AND you have the additional positive impact of the value of passing on to next generation. If you pass down an asset like this to the next generation - they don't pay capital gains tax. That's a huge savings.

So: The longer you want to hold the less crazy these prices should seem.....

My 2-cents. Hope that was valuable.

Another aspect to consider, and one I don't often see mentioned, is the currency exchange situation.

Books like this are always valued in $US. If your native currency fluctuates significantly against the US dollar, this sort of investment can be a good currency hedge. As an example, my AF15 6.0 was purchased back in '08 when the US and Canadian dollars were effectively at par. Nine years along, and the exchange rate is 1 $US : 1.35 $CDN, meaning I've got an effective 35% gain on top of the $US price appreciation in my native currency. So my 8.5k $US/$CDN has appreciated to 50k $US / 67.5k $CDN.

The rapid appreciation may be driven in part by a lot of non-US investors looking for an asset that will not only continue to appreciate, but will also give them exposure to a strong $US.

SPOILER-FILLED thread about Agents Of SHIELD

in The Movie Forum

Posted · Edited by Loki

Any Canadians know where to watch the entire finale on-line?

Severe thunderstorms in my area last night, so my satellite was either out or had unwatchable signal quality during broadcast. There are no repeat airings that I can find. CTV and the Bell app only have the second half on-line, and I can't find it on Netflix, Crave, or Amazon Prime...

EDIT - Hooray! CTV now has the first half on-line. :P