-

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

-

Posts

13,021 -

Joined

-

Last visited

Content Type

Forums

CGC Journals

Gallery

Events

Store

Posts posted by ItsJustRyan

-

-

Too hard to pick. They both are comic god artists.

-

- Popular Post

- Popular Post

- nepatkm, ADAMANTIUM, comicdonna and 4 others

-

7

7

-

-

On 5/20/2020 at 10:53 AM, Jasonmorris1000000 said:

Just some words of advice if you decide to go down this road. I’ve found that I’ve had to buy runs from private collectors on eBay in order to get high grade copies of issues that no one in their right mind would send into CGC. As a result I’ve started to amass multiple copies of issues that suck and they’re eating up space. Also at one point I wasn’t paying attention to how many $15 to $50 sets I was buying and the costs ballooned to the point where I had to sell some cool, rare, desirable stuff from my collection to offset the expense. This path may make you do some dumb investment moves to procure comics that no one but you wants graded.

This is why I don’t do the registry, but respect those that do and get the appeal. I keep my runs raw and in mylite2/fullbacks.

- ADAMANTIUM and nepatkm

-

1

1

-

1

1

-

I vote for post-modern

-

10 hours ago, BladeTX said:

Are comics like coins, where if it looks superior to the grade on the holder, people will crack them out and resubmit them. As a result the census data was always overstated. Is that the case here too?

Yes. People who care will turn back in old labels for them to be removed from the census, but my guess would be that most don’t get back to CGC.

-

4 hours ago, fastballspecial said:

Those will sell fast.

I cant keep any Invincible very long in my ebay store under issue 20.I just found the Williams Variant for the 50th issue that I had never seen before.

Do yourself a favor and read them. The first 20 issues are the some of the best

superhero books in the last 20+ years.Read the whole run. The Conquest stuff is so epic. Then you get to Thragg. And then Robot. So damn good.

- piper and Keys_Collector

-

2

2

-

Also, PSA:

The Infinity Gauntlet Omnibus is available for pre-order on Amazon. I have wanted this for years, and the secondary market prices were around $250. I actually ordered this like five years ago, but the order was canceled. Anyway, the price originally was $80 for preorders, but they’ve adjusted it up to $125 (I got in at $80). Take a look see. Contains the whole IG saga with crossover books:

-

-

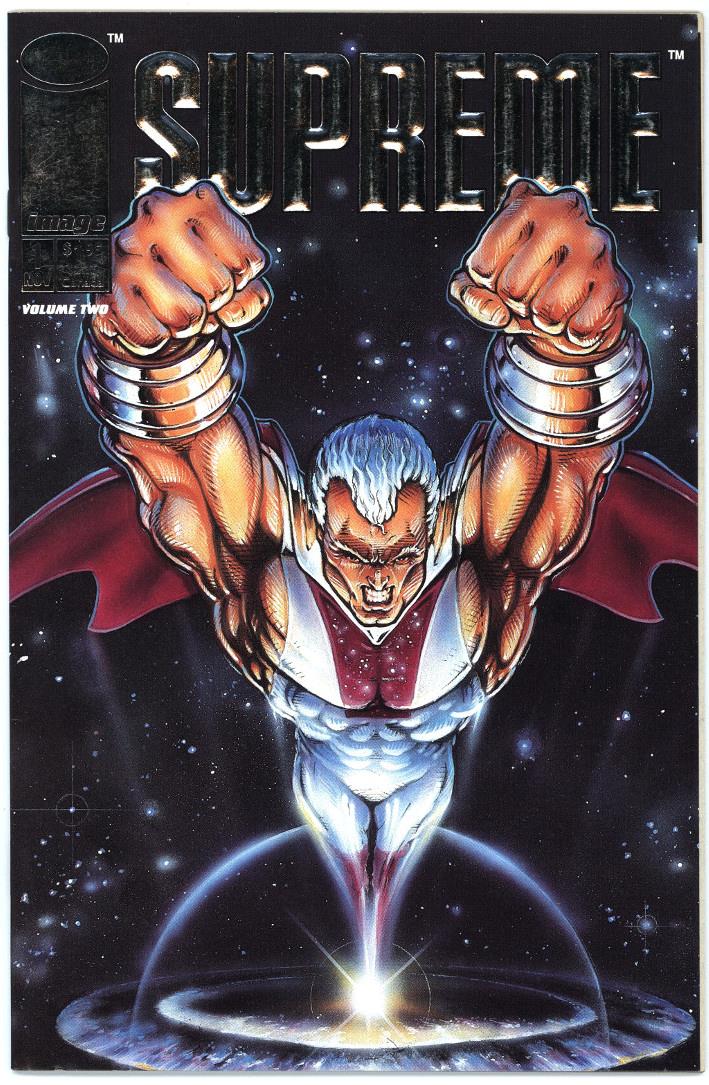

Did ya’ll forget about the best superhero comic in the universe?

-

And why have we not seen Adam Warlock on the big screen yet? Is he coming in Guardians 3?

-

-

26 minutes ago, Wolverinex said:

Dang there are pages... any certain post you recommend? not sure I can comb through a thousand pages tonight.

Just check in at the end and read going forward. Continual good info.

-

28 minutes ago, delekkerste said:

Anyway, after becoming a Bitcoin bull in 2016 and early 2017, I became a crypto skeptic in 2017-19. Bitcoin went from $20K at its Dec. 2017 peak to as low as $3136 at its Dec. 2018 low before ramping to $13851 in June 2019 and back down to $3914 at the worst of the recent asset price crash in March 2020.

I started to take note again of Bitcoin late last year, as my disgust with the Federal Reserve started to boil over. After capitulating to market pressure in late 2018 and ending their pathetic attempt to normalize their balance sheet, by the fall of 2019, with stresses growing in the financial system (overnight repo rates spiked to 10% and nobody could seem to figure out why), the Fed turned on the monetary spigots like a high-pressure fire hose in the fall, reversing the entire period of "quantitative tightening" in a matter of months. Then, of course, with the coronacrash of Feb-March, they went into full Zimbabwe mode.

Now, the old market hands like myself are very disturbed by all this and know that it's not going to end well. But, what to do? There's always gold, of course, but, many of us already had/have a gold allocation. In this environment, people, like hedge fund legend Paul Tudor Jones, are taking another look at Bitcoin (PTJ recently disclosed that his funds were taking a low-single digit position in BTC). And, whereas in 2017 I was appalled that BTC had traded up to, and then well past, the price of an ounce of gold, well, the fact that it's stayed above $3K post-crash (in fact, it's averaged almost $7500 since hitting its low in Dec. 2018), has gotten people more comfortable with the idea that this is not going back to zero and actually may have worth in a world where fiat currencies are being debased.

And, if any monetary nerd wants to argue that quantitative easing is not printing money, please go away - the only difference between QE and printing money is intent (QE = Fed intends to unwind it at some point, a notion that has ZERO credibility given the experience of the past 18 months) and a middleman (currently the Treasury issues bonds into the marketplace and then the Fed buys them up, as opposed to the Fed buying them directly in outright monetization). There is effectively no difference at this point. They're printing trillions of dollars Zimbabwe-style, and the balance sheet will NEVER be reduced back to trend levels.

Long story short: the bull case for Bitcoin is that the time may be right for one or more alternative monetary system(s), and Bitcoin (whose supply is growing slowly until it reaches its fixed maximum limit) could be the hard currency of choice in a digital age. And, maybe the market says, OK, there is a need for this with central banks lighting their currencies on fire, but, $166 billion in market cap is not enough to be useful to enough people, so, we've got to revalue this thing to a trillion or two or ten. No guarantees of course that this will happen, but, unlike 3 years ago, I now can see the asymmetric bullish case for it and have been building a substantial investment position in it. Not a recommendation or advice for anyone to do likewise; just detailing my thinking behind it.

Thank you, sir. I’m 100% in your camp.

- Action252Kid and delekkerste

-

2

2

-

2 hours ago, ThothAmon said:

Comics are my bitcoin.

Comics and collectibles are definitely a fun % of an overall portfolio. It’s why the ultra rich dabble in fine art as an invest.

-

1 hour ago, wilbil said:

this thread needs up to date info from delekkerste, jaybuck and cc (where is cc anyway?)

they know a bit more than the average person about the subject.

@delekkerste and @jaybuck43, your presence is requested.

-

To understand bitcoin you need to understand what money is, and so few people do. Money is something that humans have assigned value to. For millennia it has been physical objects: shells, metals, livestock, and even rocks. Paper money was created out of convenience because moving around heavy gold coins was cumbersome, BUT the paper money WAS tied to gold. For the past five decades, the dollar has been back by nothing but a promise of value, but the government is proving time and time again it just can’t keep its hands out of the cookie jar. The “drug” of being able to create money, to create value, is highly addictive. And what has happened is the government and those in power have created wealth for themselves and created a widening wealth gap in the USA.

Bitcoin cannot be printed into oblivion. It allows you to control your money (something humans have agreed upon to have value) in that you don’t need a bank or third party to send or receive it. Fees are low. No PayPal bullsheezy. It’s censorship resistant, meaning once you have it, no one can take it (unless you are careless). It’s open for use 24/7/365. It’s actually more secure than your PayPal account.

The volatility is a challenge and happens mainly due to whales playing the market, trying to make large price swings happen to profit from them. The volatility will subside as adoption grows. You can convert bitcoin into fiat very easily though if you didn’t want to hold funds in bitcoin.

I highly recommend reading THE BITCOIN STANDARD by Saifedean Ammous (https://www.amazon.com/dp/1119473861/ref=cm_sw_r_cp_api_i_jyGXEbWYPVDJD). It’s a lesson on the history of money, Austrian economics, and the future with bitcoin.

Cryptocurrencies are here to stay. We live in a digital world. Bitcoin is an immutable, non-sovereign, digital cash.

- WolverineX and Joosh

-

1

1

-

1

1

-

-

Magic Flute HC (P. Craig Russell) $7 (former library copy)

:takeit: per PM

-

Complete Peanuts 1950 to 1952 HC $12

*Roughneck HC $10 (Lemire)

thanks

thanks

-

3 minutes ago, raybowles said:

I had the entire set #1-#170 in CGC 9.8. Unfortunately I had to sell it plus 90+ percent of my CGC collection last year. Family emergency plus my oldest daughter got married.

I know how it is. Give and take. Keep collecting.

-

-

-

2 minutes ago, Beige said:

Ryan!!

You're back mate!

Aussie, Aussie, Aussie!!!

This week in your collection?

in Comics General

Posted

You know you’re hitting the comic crack pipe hard when you start bulk ordering mylars from eGerger, amiright?